Who gets scared when they hear the word smart budget? Why money? How much money can I earn? Do you know how much money I spend on rent and food every month? Yes, yes…

You can’t achieve your financial goals without effort, and a big part of that effort is making the 50/30/20 smart budget rule decisions.

But managing money today will help you live better, no matter how much money you make.

It’s a new year and the need to save and invest is more important than ever.

Whether you want to save money, repay your debts, or plan your retirement.

What is a Smart Budget?

A smart budget refers to a well-thought-out financial plan or estimation that takes into account the amount of money available, required for daily expenses, and set aside for particular purposes.

The best way to spend money wisely is to separate your income and expenses into clear categories and percentages.

What is the 50/30/20 Smart Budget Rule?

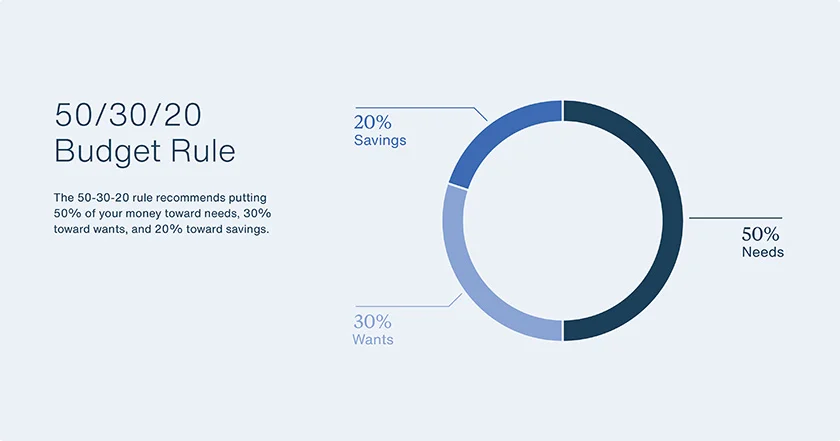

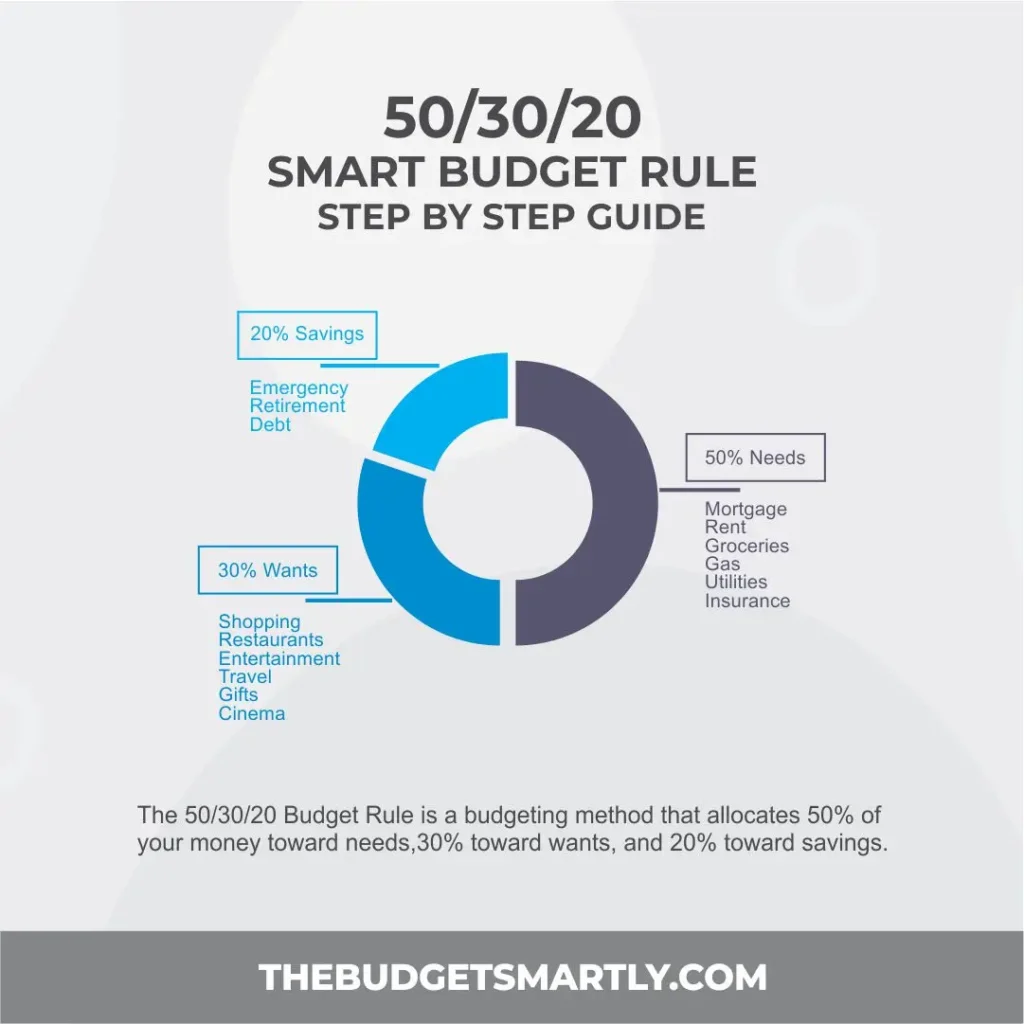

The 50/30/20 Smart Budget Rule is a budgeting method that involves dividing your money into three main categories based on your after-tax income.

Elizabeth Warren, then a professor and now a Senator, and her daughter, Amelia Warren Tyagi, explained the rule in their book “All Your Worth: The Ultimate Lifetime Money Plan.”

In her 2006 book All Your Worth: The Ultimate Financial Plan, she explains the concept. The rules are as follows:

50% for needs,

30% for wants

20% for savings and debt repayment.

How the 50/30/20 Smart Budget Rule Can Save Money

Khan, 29, who works for a consulting firm in Lancaster and earns $2,000 after tax, says, one needs to follow the basic budget when planning to save for his master;

50% smart budget rule: Khan’s Needs

These are things he cannot do.

From the home upkeep, he gives his parents for feeding, transportation, loans, and utility bills.

These are the must-dos he must do monthly.

Now to maintain this fee, Khan has decided to bring food from home to save him from the $15 he spends on lunch.

That is where a large chunk of his money goes and if he is going to save for this he has to be disciplined.

Using his $2000 income after tax, Khan needs to budget $500 for his needs.

30% smart budget rule: Khan’s wants

Khan needs to look good, buy new clothes, with accessories, and visit the cinema, after all, one doesn’t know where he can meet his “wife”.

However, he has only 30% of his salary to do this. Wants are “nice to have”.

He doesn’t care at all because surviving in Lancaster requires a work-life balance. However, flexibility is essential to comply with the 30% rule.

Instead of going to the cinema, Khan uses his Bank App and subscribes to watch movies on YouTube or Netflix.

Also, instead of buying luxury clothes that are above his budget, he can wear something smart and beautiful.

20% smart budget rule: Khan’s savings

Khan ensures he saves 20% immediately when he collects his salary.

That is $400. Khan, using the Budget App, puts an order to have the money deducted from his account after his monthly salary has been paid.

How do I make a budget plan?

Creating a budget is done by calculating your monthly income, picking a budgeting method, and monitoring your progress.

Try the 50/30/20 smart budget rule as a simple budgeting framework.

Up to 50% of income is allowed to meet needs.

Allocate 30% of your income to wants.

Allocate 20% of your income to your savings and debt payments.

Regularly track and manage your budget controls.

Is the 50/30/20 Smart Budget Rule Right for You?

The 50/30/20 smart budget rule is good for you depending on whether you have the income and budget for the right things.

When you do this, this smart budget rule can help you meet your needs and savings goals, leaving you with money to spend however you wish.

Remember, you can adjust the percentage of your spending and savings to better meet your financial goals.

Who it’s best for: People who have enough money to budget for other things after paying for basics like rent and utilities.

If you find yourself overspending on non-essentials like shopping trips, expensive dinners, the latest electronics, and other luxury items, you might find that the 50/30/20 budget rule is a good solution.

Not for: People trying to make ends meet with their current income or those in the middle of their careers may not find the 50/30/20 smart budget rule effective.

You must have enough money for both saving and spending.

To be successful with this smart budget, you should try to increase your monthly income to make room for necessities and savings in your budget.

Why the 50/30/20 Smart Budget Rule is Unrealistic?

- Inflation and stagnant wages make the 50/30/20 budget rule unaffordable.

- Costs rise while income remains flat making 50/30/20 smart budget rule unrealistic.

- It is restrictive and does not take into consideration your values, lifestyle, and financial goals.

- In an era of inflation, It’s hard to spend money on needs, saving, or investing.

Conclusion

In conclusion, following the above steps like Khan, you will realize that 50/30/20 smart budget rule does not have to be difficult.

You just have to be disciplined.

As the world transitions to normal after Covid-19, the 50/30/20 smart budget rule is a great asset.

It will also help you achieve your goals for 2024 and beyond.

Please note this is after tax.

Want to know if the 50/30/20 smart budget rule is right for your business? Yes, just subtract your expenses from your monthly income.

Our expert advice can help; Just sign up or email info@thebudgetsmartly.com for more information.

Frequently Asked Questions about the 50/30/20 Budget Rule

Here are some answers to frequently asked questions about the 50/30/20 smart budgeting rule.

What is the 50/30/20 smart budget rule with an example?

The 50/30/20 rule is when you divide your after-tax income between needs, wants, and savings.

Needs include basic expenses such as rent or mortgage, utilities, and food.

Wants include non-essential expenses like dining out and travel.

Saves include deposits or retirement funds.

Here’s how it works.

This illustration utilizes a net income of $4,000.

50% or $2,000 is allocated to needs.

30% or $1,200 is allocated to wants.

20% or $800 is allocated to savings.

What is the 75/15/10 Smart budget rule?

The 75/15/10 rule uses the same method as the 50/30/20 rule, but the percentage it distorts is different. In this case, 75% is allocated to needs, 15% to wants, and 10% to savings.

What is the 50/30/20 budget rule weekly?

To use the 50/30/20 rule weekly, calculate your weekly after-tax income and put 50% towards needs, 30% towards wants, and 20% towards savings.

What is the 50/15/5 budget rule?

The 50/15/5 rule is when you divide your after-tax income into categories — 50% goes to essential expenses, 15% goes to retirement savings and 5% goes to short-term savings.

What you do with the remaining 30% of your income is left up to you.

How do you make a smart budget spreadsheet?

Start by determining your take-home income, then take a pulse on your current spending.

Finally, use the 50/30/20 budgeting rule: 50% for needs, 30% for necessities (wants), and 20% for savings and repayments.

How do you keep a Smart Budget?

The key to saving money is to track your expenses regularly, so you know exactly where your money is going and where you want it to go.

Here’s how to get started:

1. Check your account statements

2. Categorize your expenses

3. Keep your tracking consistent

4. Explore other options

5. Identify room for change

Free online spreadsheets and templates make budgeting easy.

How to Create a Smart Budget?

Start with a personal financial analysis. Once you know where you are and what you want to achieve, choose a budget that suits you.

We recommend the 50/30/20 system, which divides your income into three groups: 50% for needs, 30% for necessities (wants), and 20% for savings and debt repayment.

What is the 70/20/10 Smart Budget?

This smart budget follows the same formula as the 50/30/20 smart budget rule, but the percentages are adjusted to fit the average American budget.

70/20/10 recommends spending 70% of your income on essentials and discretionary expenses, 20% on savings, and 10% on debt. The reality of the decline in the average customer’s purchases.

What is an 80/20 Smart Budget?

Another percentage, the 80/20 budget can fall into two main categories; Better for people who don’t want to analyze all their expenses.

80/20 Planning Made Easy.

You don’t need to classify every amount as essential and for non-essential expenses, you can deposit 20% of your salary directly into your account sufficient.